Why a credit score is significant?

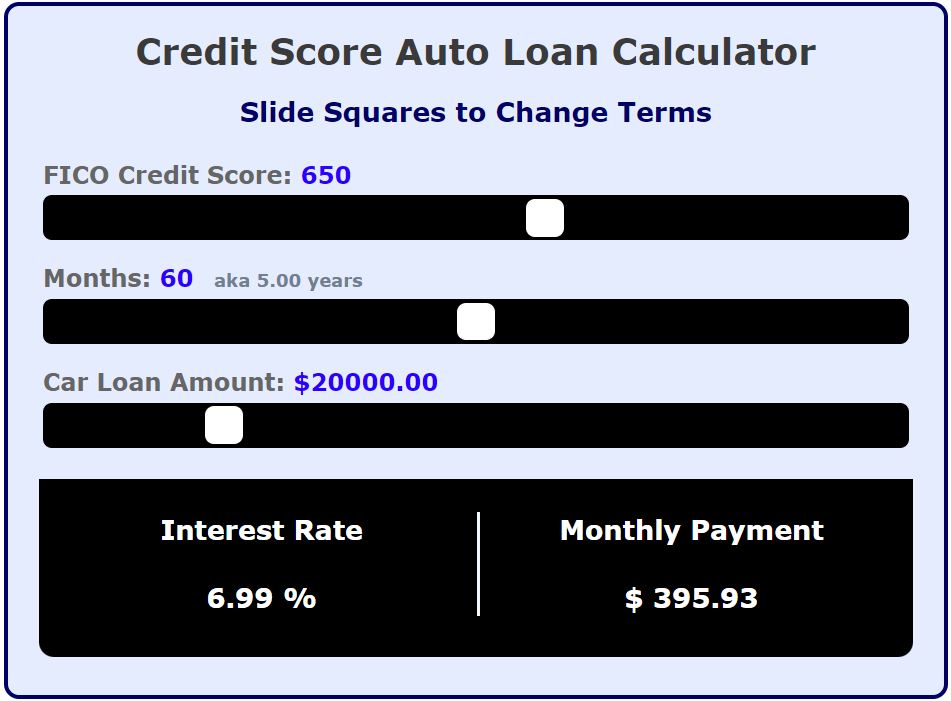

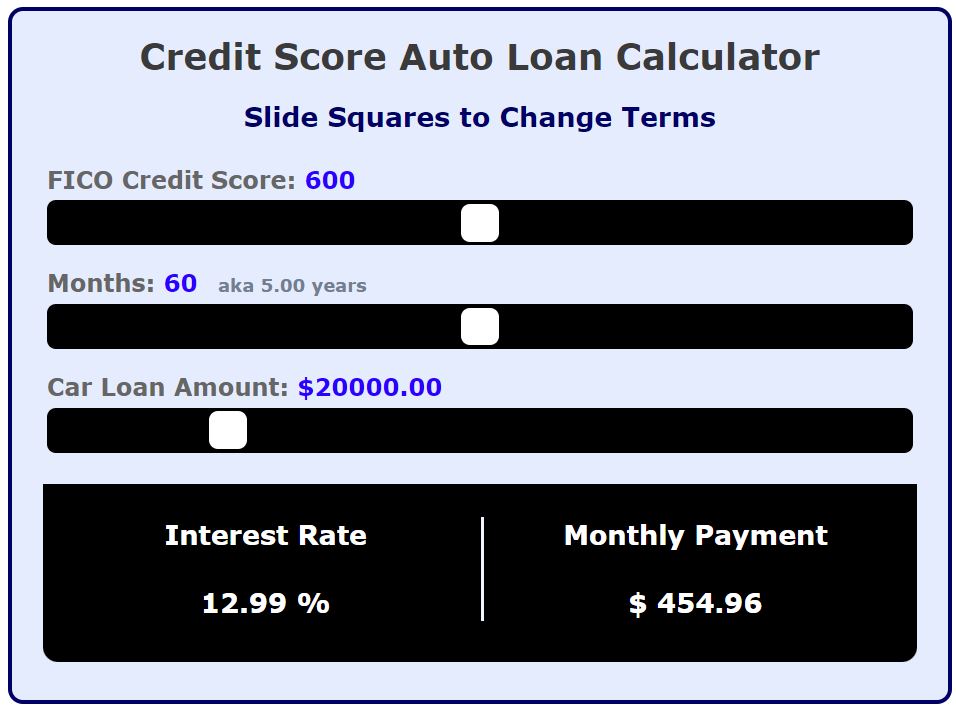

Picture this, You and your best friend graduate from college and get the same job paying the same amount. You both decide you have earned a lightly used 2-year-old car, because your financially savvy & know a new car loss its value as soon as you drive it out the lot. Time to car shop! You both get a car costing $20k. Despite your similarity your monthly payment would be $455 & hers $396. You think this is unfair & ask the dealer. WHY?! It turns out your friend was sharp; she got her first credit card in her freshman year and built her credit up to 650 while you only used your debit card. Your score is 600. What does a 50-point credit score difference mean for the life of this loan? Your friend would pay $3,540 less for a similar $20k car. So, how do you build your credit?

Types of credit Cards

A credit score is one of the most important numbers in an adult’s life. It can decide if you can get approved for a car loan or a house and the interest rate you pay. That is why I regret not applying for a credit card while I was in college. Don’t be like me start building your credit early.

Did you decide to build or repair your credit? Great! There are two types of credit cards you can apply for right now. Secured or unsecured.

A. Secured Credit Card

A secured card means you have to give the bank a collateral in order to be approved & help build your credit by reporting to the 3 credit reporting agencies. So, if bank ABC approves you for $1000 secured credit card, you give them the $1000 to hold as a collateral. You then have the freedom to spend up to a $1000 a month and pay the balance/minimum each month when your statement (bill arrives). Once you prove you are responsible most banks will give you the $1000 back and change your credit card to an unsecured one. There are some credit cards that will never change from secured to an unsecured. Check with the card issuer before applying.

Book recommendations:

B. Unsecured Credit Card

An Unsecured card is a credit card without a collateral. A bank will give you a credit card after you apply without any money from you. For instance, if Bank 123 approves you for $500 card, you can spend up to $500 a month. At the end of your billing cycle the bank will issue a statement of how much you spent, and you would have to pay that amount or the minimum.

You should try applying for an unsecured credit card first. There are some credit cards created to help students build a credit. You have better odds of getting approved. I am sure you need the $1000 more than the bank does anyway. If you don’t get approved for one go for the secured.

What types of credit cards should you apply for?

Here is what I would look for in order of importance.

- Does the card have an annual fee? Stay away from these. This will be a card you will keep for a long time. Most people don’t close their first credit card even when they are in their 50s. It will have your longest credit history, which is a factor in calculating your credit score. You don’t want to pay an annual

fee for years. Find ones with 0 annual fees. - Do they offer rewards/cash backs? Some credit cards have a good sign-up bonus. Go for these if they are available to you over others.

- Pay attention to the interest rates. Credit cards are notorious for having high interest rates (APR).

Stick to these 4 rules

After you have been approved for a card, you should.

- Pay your balance in full each month.

Although credit card companies will let you pay a minimum balance, its usually 1% of your utilization amount. So, if you spent $1000 it would be a $100 minimum payment. Don’t fall for this trap. Credit cards have one of the highest rates, the interest will add up before you know it. Pay your balance each month. In this case pay the full $1000. - Don’t use more than 30-35% of your limit.

If your limit is $1000 don’t use more than $300-$350. If you spend more, you will hurt your credit score. If you overspend before your bill is issued, bring down your balance by paying it earlier. Let’s say your bill was due on the 30th but by the 15th you had already spent $400. Pay $50 on the 16th to bring your utilization down to 35%. - If you can’t buy it twice you can’t afford it.

Don’t purchase things you can’t afford thinking you can pay the minimum and pay it off. This is still your money. - Be picky about which credit cards you apply for after your first one.

Once you have your first credit card, the other banks will almost beg you to apply to theirs. You will get a lot of mail & emails. Be picky, there are a lot of good credit cards out there. The next one will be better than the current offer you have. Don’t rush.