There are several misconceptions about how to pay off your mortgage faster. Is it even worth it ? What is the smartest and most efficient way to go through your mortgage pay off ? There is so much information out there on how you should go about doing this.

What prompted me to write about this

I wanted to write this article after stumbling on this video. A woman explains a plan to pay off a 30 year mortgage in 15 years by paying 1/6th of your principal and interest payment as an extra payment on the 15th of every month.

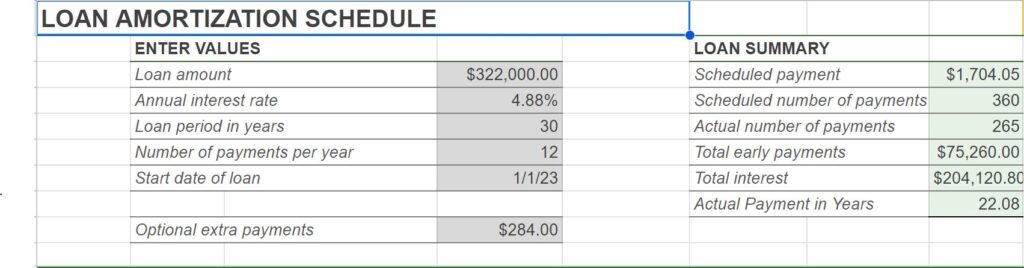

This “hack” is decent and you will save a lot in interest payment but it will not be 15 years. If you follow this video this is what your schedule could look like.

These schedules will be different if your mortgage amount and your interest rates are different. Lets explore some scenarios.

Mortgage pay off explained on video

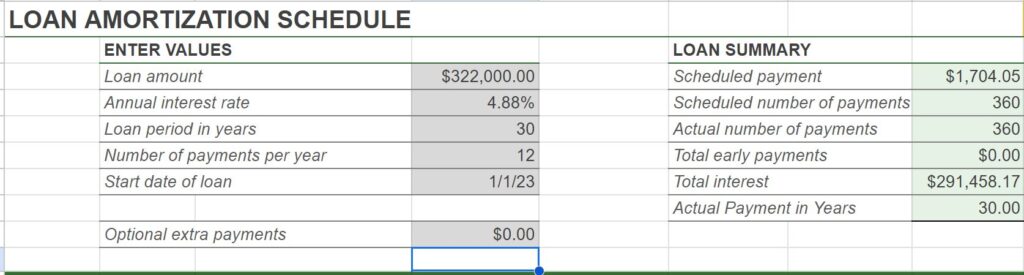

The regular payment schedule below shows how a 30 year payment would look. If you compare the 2 you will save over $87,000 in interest and have your mortgage payed off 8 years earlier.

Paying off a low balance high interest mortgage loan

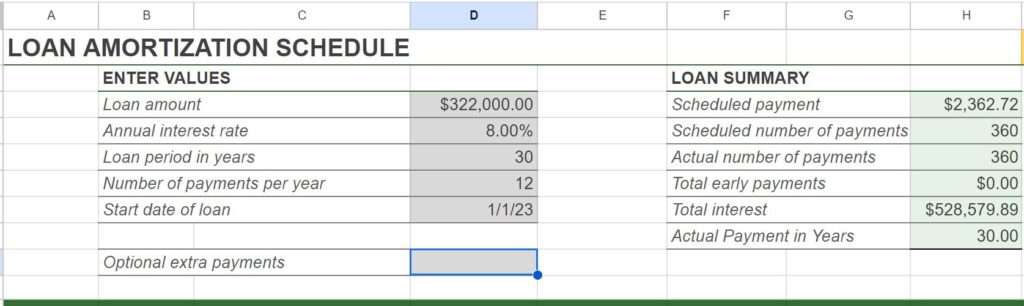

What if you had to pay off the same loan amount of $322,000 with an 8% interest rate. This is what a regular 30 year mortgage would look like.

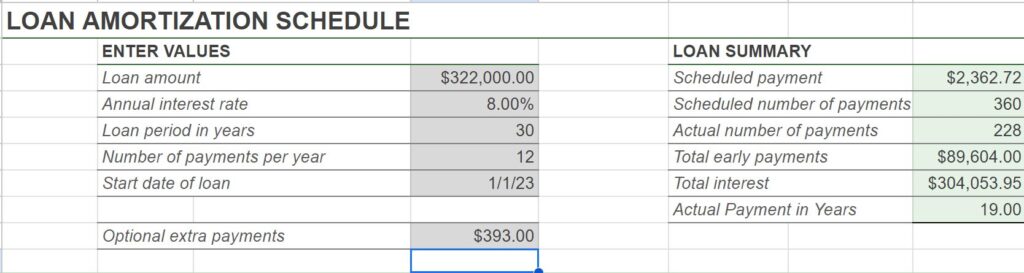

If you pay 1/6th of your monthly payment extra , $2,362/6 = $393. You will save $224,000 in interest payments and pay your mortgage off in 19 years.

Paying off a high Mortgage balance with low interest rate

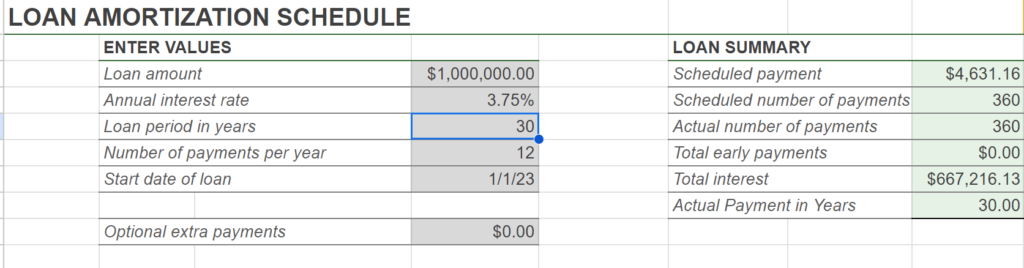

What if you had a $1,000,000 mortgage loan with a 3.75% interest rate. How would this work ? This would be your regular payment. You would pay $667,216.13 in interest alone.

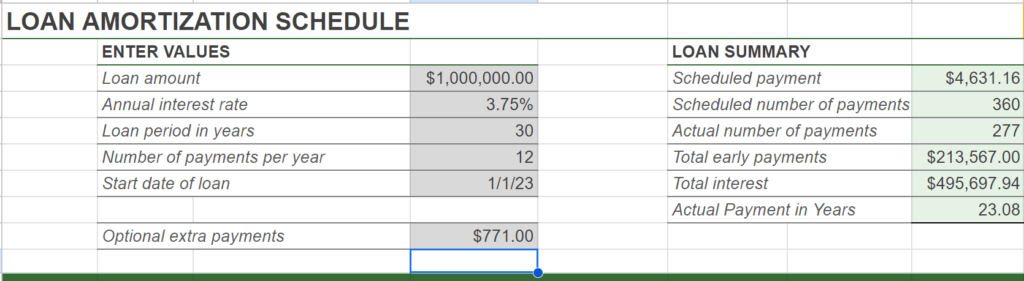

If you pay the extra 1/6th- $4,631/6 = $771

It would take you a year more and save you over $171,000 in total interest. Fair, because it is a more expensive house.

Paying off a high mortgage balance with high interest rates

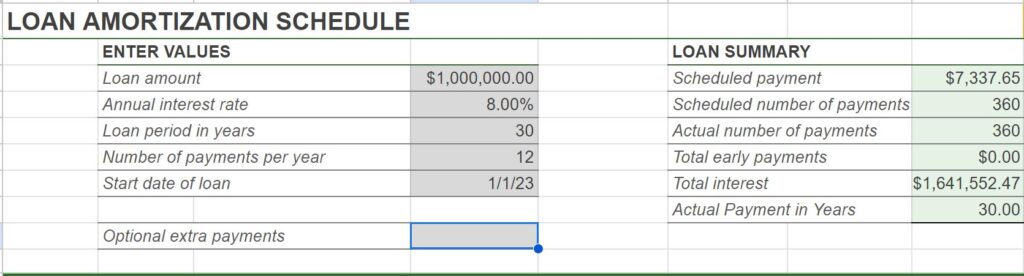

What if you had a high interest rate ? As I am writing this interest rates are close to 8%. Lets see what would happen with a million loan and an 8% interest rate.

You will pay $1.641 million in interest payments alone ! This could buy several houses with just the interest payment.

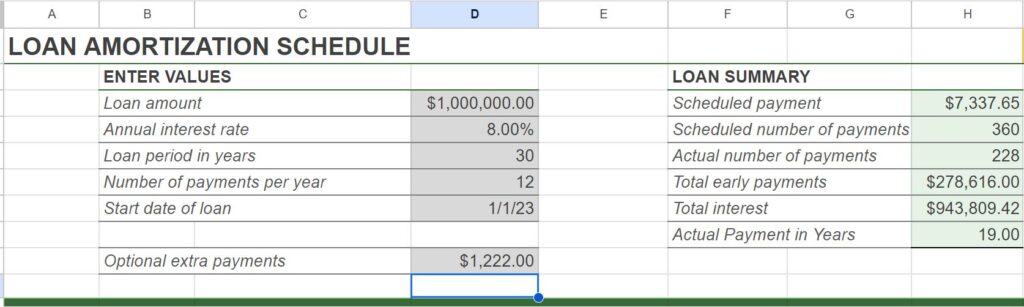

You can see the impact the extra 1/6th payment makes below. It is major ! This can pay off your house in 19 years and you save over $698,000 in interest rates alone.

Though I think paying your mortgage balance off even a year earlier than scheduled is exciting. This plan does not do what it promised. It also has a huge impact if your loan and interest rates are high.

Like this post ? Also read: How much money is enough ? or 5 Easy Ways to $1 Million Net Worth