** Money Diary is about learning from fictional stories. If children can learn for tales and fables why can’t adults. This post will explore the allocating your paycheck well to generate wealth. **

Meet Samantha, she has an eccentric money mindset (a belief about money). She has a good job paying her six figures plus commissions. She lives in a low cost of living city and she spends every bit of her paycheck. Thankfully she does not believe in debt and pays her credit card balance in full on time. It is a value her accountant mother instilled in her. She may not have listed to most of her mother’s money lessons but she practiced this one diligently.

From a young age, Sam knew she wanted to live like her friend Carry and her family. They lived a fabulous life: vacationed internationally twice a year, spent lavishly on shopping trips and bought everything new. Unlike her family no purchase was over analyzed and they lived in the moment. Carry’s mother had a beautiful walk in closet filled with designer bags and expensive shoes. Her mother bought non brand items and bargained for sales. Sam did not understand why these two seemingly similar woman in all aspects: house, income and age, could be worlds apart.

When she was 18 both Sam and Carry were accepted to the same college. They both studied computer science and graduated in four years. They also got similar jobs and became roommates. Sam was living the dream. She had a house mate she liked, a job she loved and a pay check she spent. It was like a dream.

The only problem was Carry’s money mindset. She over analyzed every spending. One day Sam decided to ask Carry about it.

Sam: “how come you are always budgeting & analyzing your spending ?”

Carry: ” I have to, I have to plan for my student loan & car payments plus savings and investments”

Sam: “why do you have student loans and car payments ? did you parents not pay for school ? What do you mean by investments ?

Carry: “my parents were broke when I was going to school, unlike your parents they did not have money saved up for school. They spent everything they earned and we were living paycheck to paycheck. I took over my car loan after I graduated from college because I wanted them to start investing for their retirement.”

Sam was shocked, she could not believe her privilege. She decided to audit her own life. Sam did not want to end up old and broke. She looked at her savings account. It had a balance of $3000 which, was less than her monthly paycheck. She also had her employer contribution 401k of $15,000.

Read other Money Diary series:

1. How to turn your finances around

3. A single mom exceling in her personal Finance

Changing her Money Mindset

She had worked 5 years and had very little to show for it. Sam decided to change her money mindset and ask for help. She did not want to involve her mother. She looked at XY planning and hired an hourly advisor. He recommended she max out her 401k by adjusting her limit on the HR provided portal to 22% and auto increasing 1% every year. Start saving for an emergency for 3 to 6 month of her monthly spending, forgo the life insurance since, no one depended on her. He also suggested saving 10% of her paycheck for any non-retirement related goals after her emergency fund was complete.

Sam realized she had a lot to work with, when it is all said and done she had enough for eating out and enjoying life. She just had to be mindful. It never took over her life but it guided her. She learned to prioritize some spending’s and let go of others. She bought a nice bag every now and then but it did not bring her as much joy as before. The designers were not worth her future. Sure some bags were investments but nothing grew as fast as her investments.

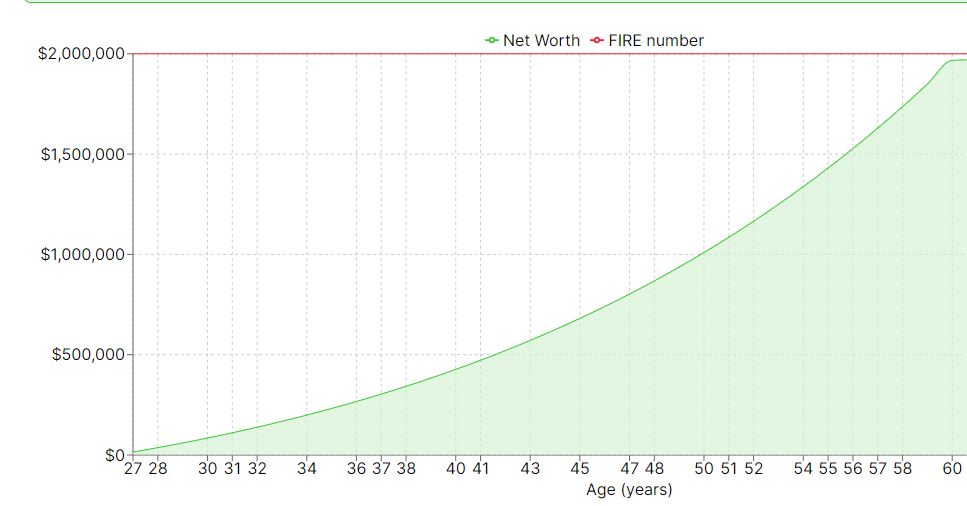

Five years after meeting with the advisor. Sam had a completely new money mindset. It did not happen over night but the gradual changes payed big. She had $138,000 in her 401k. Had a six month emergency fund and about $30,000 in her savings for a house purchase. By the time she was 60 her 401k alone would be worth $1.9 million.