** Money Diary is about learning from fictional stories. If children can learn for tales and fables why can’t adults. **

This money diary will focus on the impact of different financial plans. It will highlight saving and investment overtime. You will read about three successful woman growing their net worth. They will invest the same amount for the same number of years. For the simplicity of this financial plan comparison we will not consider the impact of inflation.

Meet Kathy, She is a 23 year old woman who works hard in medical sales. She has been in the field since

graduating college. She has a very conservative outlook on finances. Mostly because of her parents. They

were children of the ’08 financial crisis, who lost most of their money in the market. They panicked and sold

at the lowest point in the market. This cost them a decade of retirement and millions. They were great at saving

but bad investors. They ingrained it in her. To save and stay away from the market.

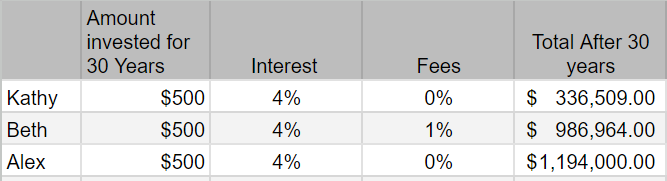

She saved $500 at 4% every month in a high yield savings account. In 30 years she had a total of $336,509. This

is a good amount but not enough to retire with.

Book recommendations:

Beth is Kathy’s coworker. Her aunt is her financial advisor. She has it ingrained in her since her first high school

baby sitting gig to invest. That is why she is her financial advisor. Beth did not want to deal with the day to day

hustles of investing or constant paperwork needed.

Just like Kathy she invests $500 a month in a total market fund. Her investments grow at 11% every year. Her aunt

charges a fee of 1% every year. In 30 years her investments will grow to $986,964.

Alex is Kathy’s friend. She is a teacher and a lifetime learner. She researches and listens to several personal finance

podcasts. Through this research she learned that how to develop a financial plan using vanguard to invest in a total market fund.

She starts investing $500 every month for 30 years in a retirement account. She automated and only logged in to checked once a year. Her investment grew at 11% and her fees were 0.04%. In 30 years her investments grew to $1,194,000.

Here is how their investments are different.

There is a big difference between Kathy (who invested in a high yield savings account) and Alex (who invested in a total market fund).

These two have a difference of $857,491. There is also a big difference between Alex and Beth (who had a 1% fee) of $207,036.

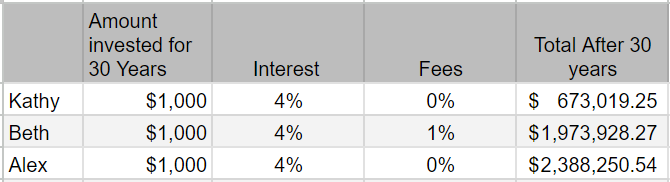

The difference would be substantial if they invested $1000 a month for 30 years.

Financial Lessons from this money story:

- Investing early is important -the earlier you start the better.

- Past family history should not affect your investments. In this money diary Kathy’s upbringing hurt her financial plan.

- You don’t need a financial advisor to invest in the market. If its too intimidating to start investing on your own hire an hourly rated financial advisor. There are several fee based financial advisor’s out there, XY planning has several CPA and CFP’s to chose from.

- The larger the investment the bigger the impact. In the images above you can see how much the difference is between a savings account with a $1000 vs. $500 investment.

Read other Money Diary series: