So, you have debt & you want to pay off, but you don’t know where or how to start. Breathe, I GOT YOU! You should not feel overwhelmed after all its not life or death. Your debt does not define you. Yo can pay off debt while living your best life. It should not limit you from living your best life. You just need to understand what got you there and how to slowly get out of it. First you need to understand debt.

Understanding debt:

a. Your debt lasts only for your lifetime – Here is an interesting fact about debt in the U.S. It will only follow you for your life time. In some countries like South Korea consumer debt is inherited. If your assets don’t cover your debt your kids inherit it. Imagine inhering your parents student loans.

b. Understand how compounding works – This just means most of your payments will go to the interest rate instead of the principal or loan amount.

If you have a credit card balance of $5,000 with 23% APR (annual interest rate) until the 46th month a $100 payment will get allocated as $10 to principal and $90 to interest. By the end of the loan the $5000 will have grown to $16k and taken 14 years to pay back in full.

c. All debts are not created equal– in the personal finance world there is good debt and bad debt.

Good debt is what we would consider as an investment. For instance borrowing money to grow or start a business or borrowing for items that increase in value (house). Examples of bad debt are credit cards, car loans or excessive student loans.

There is a fine line for some loans to turn from good to bad. For instance too much house, more than 35%, of your take home pay would easily fall into bad debt. Here is a rule of thumb, if the loan does not generate income, reduce your expenses or help you increase your net worth, its a bad debt.

d. A Small extra payment could cut your time in half – because extra payments are allocated to just principals, even a micro one, can have a ripple effect. The more consistent these small payments are the more likely you are to cut your time in half.

Now that you have a better idea about debt, lets figure out why you are in debt? Most people accumulate debt for one of two reasons.

First reason: they have an income gap. Second: they have a spending problem. Before you do all the hard work pinpoint which problem landed you in debt. If you don’t do this you are bound to repeat the cycle. Be honest with your self.

Armed with information its time to tackle your debt. Use these steps to keep yourself from being overwhelmed.

Following these should allow you to cut back from a YOLO life style but not deprive yourself from LIVING. After all no one thinks about the debt they have on their deathbed just the life they lived.

- Use a budget

Budgets may not be sexy but they are necessary. You cant control or understand what you don’t track. For most budgets are antagonist. As if it just takes all your money and runs, it doesn’t have to be that. It is your own construct.

A budget is as constricting as you make it. GIVE YOURSELF ROOM. If you like your $6 Starbucks drink add it, just know what truly gives you joy and what has become a bad and expensive habit. Your budget can be on paper or a computer, crazy complicated or simple.

It does not matter ! If you are an excel nerd like me, go crazy! Build a chart, add a table but, if you like a simple one limit your categories. Being consistent with budgeting matters more than how fancy your budget looks.

Once you create a budget its time to pick on some items. Focus on your biggest expenses – typically rent/mortgage and transportation.

Here are some savvy budgeting strategies to consider:

*Downsizing your living space: If you’re renting or have a mortgage, downsizing to a smaller home or apartment can help reduce your monthly payments.

*Negotiating rent or mortgage rates: Consider negotiating with your landlord or mortgage provider to secure a better rate.

*Carpooling or using public transportation: Cutting back on driving, downsizing to a car or sharing rides with others can reduce your transportation costs significantly.

*Taking advantage of employer benefits: Check if your employer offers commuter benefits or other cost-saving programs.

*Renting out a spare room or parking space: If you have extra space in your home or a parking spot, consider renting it out to generate extra income.

By identifying ways to downsize or subsidize your largest expenses, you can make a significant impact on your budget and achieve your financial goals faster.

- know your money psychology

Take a look at your budget again. Are there items that surprised you ? Was it small spending here and there or did you buy one or two expensive items ?

Do you shop more online ? Did you plan for these purchases or were they impulsive buys ? How much are you spending on eating out ? food ? drinks ? Answering these questions will allow you to understand where you went south.

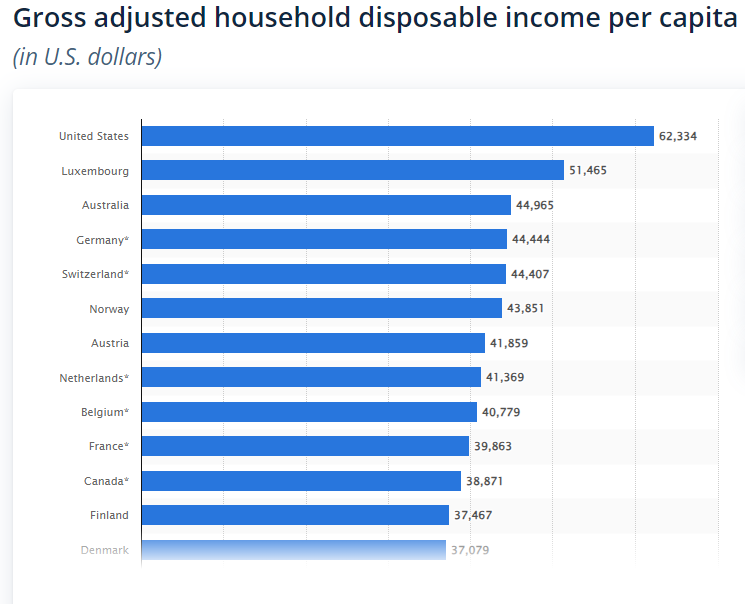

According to statistia in 2021 the U.S had the highest disposable income (take home pay) compared to other developed countries. You know what we also have the most of… DEBT!.

Which means our money psychology plays a big factor. We are constantly living in a YOLO state. You can make adjustments to your money psychology until it become a habit.

Here are some YOLO remedies:

- If you over shop online – never save your credit card information on online sites especially Amazon. We modern humans are lazy by nature. If you have to perform an extra step to get your items chances are you won’t complete your purchases.

- If you over shop in stores- leave your cards at home. Take cash only for the items you planned to purchase. Spending cash hurts.

- If you over spend on travel- plan your trips in advance. Cost share with friends. Use credit card points.

- If you spend too much on eating out- meal prep most meals & order water when you dine in

- List your debts smallest to largest

If you are on step 3 you have done most of the work already. Its time to start automating. List all of your debt, smallest to largest. If you have zero interest items list the item by end of promotional period. After this pick a strategy: Snowball or Avalanche.

Snowball method says you should pay smallest to largest. Though this may not make the most sense mathematically, because some interest payments will be higher than most, it is psychologically the most rewarding. When you see the smaller items disappear from your list, you will be more motivated.

The avalanche method says to list items based on interest rate from highest to lowest. You want to pay off the highest interest rates first because it has the largest interest to principal allocation.

Whichever method you use, Action is better than inaction. The main trick is to pay the minimum on all of your debt except the one you are going ham on.

Book recommendations:

Once that payment is complete, you move on to the next one until you are DEBT FREEEEE!!.

BONUS: Pay attention to fees. Banks make millions on charging you fees. In 2019 banks made a combined $8.6 billion across the first three quarters in just overdraft fees.

- Find Extra cash & Side hustle

Paying off debt can become addictive. That is why when people start paying off debt they get into analysis paralysis. The best way to help yourself in your debt journey is by adding income.

Start by listing items you don’t need. You can list them from the comfort of your home on cragslist, offerup or poshmark. You can also do the tried and tested garage sale.

After you do this reward yourself. Decide on a reward and debt pay off percentage. So, if you make $100 keep the $10 (10%) for fun and use the $90 to pay off your debt.

Find instant paying side hustles but don’t just go for any side hustle. Think of a skill your good at and the possible expenses associated with the side hustle.

For instance, I love food delivery services but they don’t pay much and any one with a car or a bike can do them. This means I would compete with a lot of people for high paying deliveries and I would have expenses like gas & wear and tear on my car. BE SMART ABOUT YOUR SIDE HUSTLES.

Here are some examples of better side hustles :

-Teaching a wellness class/become a personal trainer- if you are a gym rat, know more about diets than a dietician. Please do the world a favor and get involved. This is a triple threat you can stay fit, get paid and help others. Plus your gym membership will either be free or tax deductible.

-Babysitting- If you are a mom or have taken care of siblings this is a skill you can do easily. You might even turn it into a business.

-Tutor- If you took AP classes or have a degree this is a lucrative side hustle. You can do it online with international students or you can tutor locally.

-Delivery driver- If you have a CDL (commercial driving license) you can get a job part time at your local UPS or FedEx. If you don’t have one, some companies are willing to pay you while you get your CDL. It pays a high hourly rate and there is a huge market for it.

-Virtual Assistant (VA)- If you have a regular office job a VA job is not too far off. Most are flexible and pay decent wages.

–Rover/dog walker-if you are an animal lover sign up to be your own pet hotel or become a dog walker. This man makes over $100k per year doing just that.

-gig based jobs- if you cannot commit to specific times and want flexibility, look for gig jobs on cragslist, task rabbit , Adia or Bacon. You can be an extra or a double for a movie star.

-Become a cleaner- if you are OCD and love cleaning, you can become a cleaner or create a cleaning company. You can also become this lady, she makes millions posting herself cleaning on youtube.

Think outside the box. Ask 3 of your friends to list 10 skills you are good at and build from there. Don’t just follow the heard.

BONUS-Make sure to also check “unclaimed checks” for every state you lived in. Just google “unclaimed checks YOUR STATE” and search your name on the states unclaimed checks website.

- Excel at time management

You maybe wondering what time management has to do with debt pay off. EVERYTHING! Your time is your biggest resource. You can use it for productive things like: generating income, keeping yourself healthy or

learning a marketable skill.

You can also waste most of it watching TV, shopping online and getting yourself into more debt. Learn how to manage your time.

If you have a hard time with time management or if you are always thinking “where did the day go ?” read 168 Hours you have more time than you think or Four thousand weeks.

Bundling is not just for insurance. It works for your personal life as well. For instance, if you like to workout teach a class. This will allow you to save time, make money, cut the cost of a gym a membership and most of your workout outfits will be tax deductible.

If you live with others delegate! You are not doing yourself or others any favor by doing everything. If you have teenagers, assign a dinner day. They learn a life skill, you get time off and it will be a team building moment.

- Be kind to yourself

Be kind to yourself, you did not get into your debt or any bad situation overnight. It takes months and years and so will the debt pay off. Live and learn from your mistakes. If you are reading this, chances are you have already started on this path It’s ok if it doesn’t go to plan. Nothing ever does. The best thing you can do is: keep moving, take action.

Like this post ? Also read: How much money is enough ? or 5 Easy Ways to $1 Million Net Worth