You will never be younger than this moment. So, its important to plan for when your older. This is an important part of the “Adulting” journey. Having a retirement strategy might feel like a dauting task but it does not have to be. You can use some guidelines to start this process.

A. Determine retirement goals and lifestyle

What does your retirement look like ? Do you expect to have more expenses or less ? Do you want to drive a fast European car? Live in a big house or downsize ? How many times a year will you be traveling ? How charitable will you be ? These and many more questions need to be answered first in order to figure out your retirement number. Your retirement number will be 25 times your yearly expense. For instance you need a $1,000,000 if your expenses are $40,000 a year. The sooner you achieve this the sooner you can retire.

You need to keep track of these major items when you plan for retirement.

- Inflation-is your purchasing power. A $1 today purchases less than $1 20 years ago. The same applies for retirement. The U.S experiences an average of 3% inflation per year. You can plan this into your retirement number reducing your return by -3%. For instance if your investments make a return of 12% you can adjust it down to 8%.

- Healthcare Costs-This is something you cannot plan for but you can certainly prepare better. You can purchase additional coverage

and create a medical proxy for the bad times. You can also invest in tax advantaged Health savings accounts (HSA). These allow you to invest pretax and use the funds without tax for any healthcare related expense. If they are not used for healthcare you can withdraw the funds after tax. If you use your HSA for non healthcare needs before the age of 65 you have to pay a 20% penalty plus current tax rate. - The power of Compound interest-There is nothing more satisfying than seeing your money multiply. Compounding does exactly that.

Your money will generate money without additional contribution, at times it will double. This will depend on your rate of return. If your return is 8% your money will double every 9 years (70/8%). This would mean if you invested $10,000 today your money would be $20,000 in 9 years. Start investing as soon as possible to give your money the best chance to grow. Time is money.

Book recommendations:

B. Pick the right retirement accounts for your future lifestyle

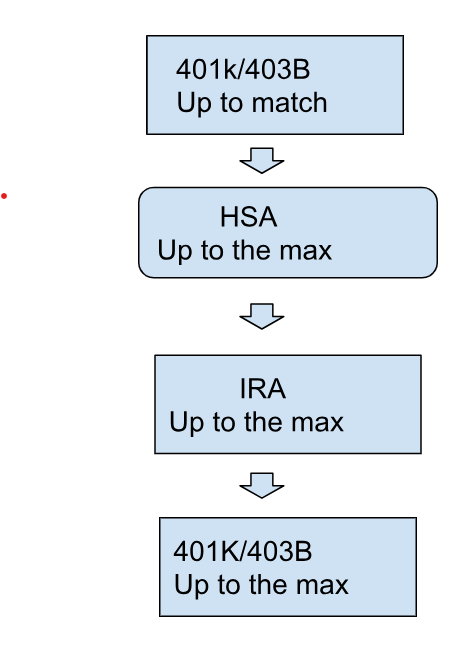

Do you want to reduce your tax liability at retirement or now? If you want to reduce taxes now: traditional 401k, IRA and 403b are best. If you want to live tax free; you should invest in the ROTH counterparts. If you have a high deductible insurance you can also qualify for an HSA. Because it provides: pre-tax savings, tax-free growth, and flexibility this account is the star of all accounts. If you don’t need this for healthcare it will become similar to a traditional account. You pay taxes when you use it. Your order of investment should be:

C. Keep an eye on your Expense ratios

All investment accounts have an expense ratio. The higher they are the more they will eat into your retirement. If Person A with a 2% annual fee and Person B with a 0.04% annual fee invest the same amount for 30 years: person A would have $745k and Person B would have $1.1 million. So, How can you be smart about your expense ratio? Pick an index or target date funds with low fees. If you get an advisor, make sure you pay for an hourly fee and not an assets under management (AUM).

D. Set realistic Investing goals

Find a balance between yolo and Raman noodle life. Don’t set unrealistic saving goals at the expense of your current life. Leave some room to live and experience life. Tomorrow is guaranteed to no-one.

E. Reduce your Risk by diversifying

Do not put all your eggs in one basket. You need to diversify your investments. You can purchase real estate, gold or bonds. The percentage you invest in these will depend on your risk tolerance and age. The younger you are the more aggressive you have to be. If you are older and closer to retiring; be more conservative. Invest more in bonds and/or two to three years of expenses in cash.

It is important to understand your retirement needs and setting realistic saving targets. Try to begin with the end in mind. Explore various retirement account options and the benefits of starting early to take advantage of compound interest. Additionally, emphasize on diversification in your retirement investments and managing risks through insurance and proper asset allocation.

Now is the time to take action. Don’t wait any longer to start saving for your retirement. Every step you take today brings you closer to a more secure future. Begin by assessing your current financial situation, determining your retirement goals, and implementing a savings plan that aligns with your objectives.